by superadmin | Sep 10, 2025 | VAT

Value Added Tax (VAT) is something sole traders and companies must charge once their turnover exceeds £90,000 in a rolling 12-month period, or if they will exceed this amount within a three-month period. At this point, you are obliged to register for VAT with HMRC....

by Ruth Clark | Feb 5, 2024 | Uncategorised, VAT

How to treat Input Tax: Pre-registration, Pre-incorporation and Post-deregistration claims to Input Tax under Regulation 111 ? Background Only a person who is already registered for VAT can exercise the right to deduct input tax. However, there are certain...

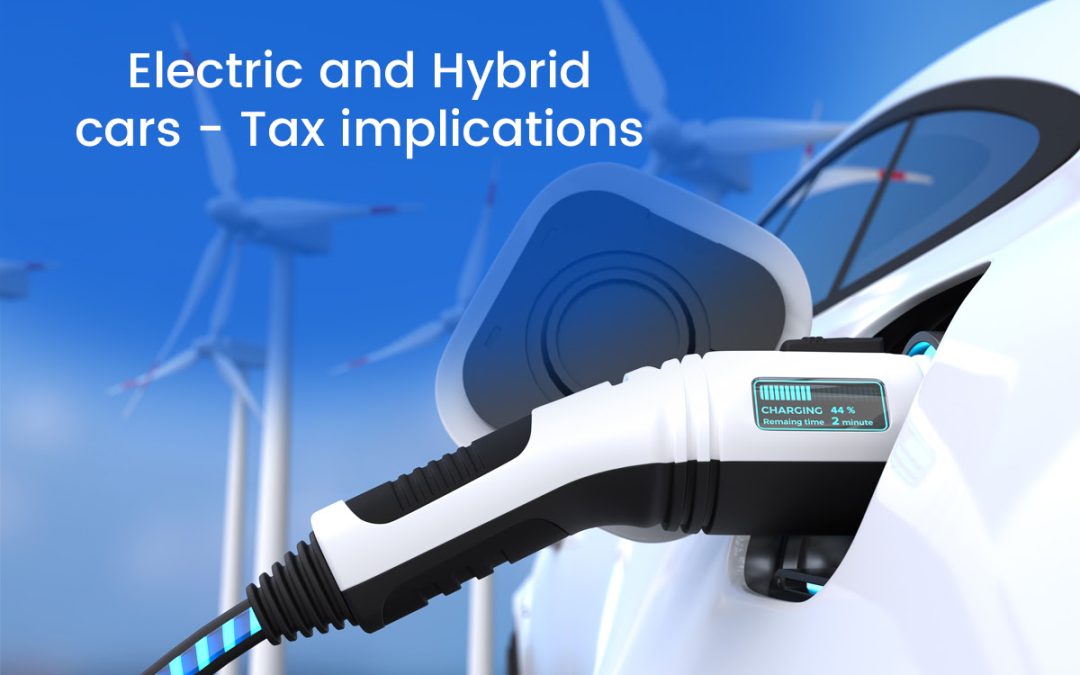

by Ruth Clark | Aug 28, 2023 | Tax, VAT

There are some commonly held misconceptions about the VAT breaks for businesses buying Electric and Hybrid cars, even by car dealers trying to sell a new car. Input VAT Claim rules It is not uncommon for car dealers to tell buyers that their businesses can recover the...

by Ruth Clark | Jul 17, 2023 | HMRC, VAT

VAT: An inspector calls! A business will have a visit from a VAT inspector for one of two reasons; a routine visit after selection by the HMRC computer based on the type of business and the level of turnover, or if the business has an unexpectedly large VAT repayment....

by Ruth Clark | Feb 27, 2023 | Tax, VAT

New system: The new VAT penalty system will apply to VAT periods starting on or after 1 January 2023 and will deal with late returns and late payments separately. Both legs of the system will reflect taxpayer behavior, and seek to punish persistent offenders rather...

by Ruth Clark | Feb 8, 2023 | VAT

A new VAT penalties regime was brought in this month, and any firms or individuals missing their filing deadline from January 2023 onwards will receive penalty points even if there is no VAT due to be paid. While this may sound more benign than getting a fine,...