by Ruth Clark | May 6, 2022 | HMRC

Businesses must overcome several hurdles in order to claim back input tax: it’s not just as simple as having a purchase invoice. Any input tax claimed by a business must relate to a supply that has Actually taken place. Claim what should have been charged You can only...

by Ruth Clark | Apr 29, 2022 | HMRC

The rates of pay set by the National Living Wage and National Minimum Wage increased on 1 April 2022. Those employers that flout the National Minimum Wage laws risk more than just being forced to repay underpayments. There are significant fines, and HMRC is now...

by Ruth Clark | Apr 26, 2022 | HMRC

Buying a property in need of work is cheaper than buying one where everything has been done. However, the costs involved in renovating or altering a property are likely to be significant. The extent to which any tax relief is available will depend on how the property...

by Ruth Clark | Apr 8, 2022 | HMRC

Around 2.5 million UK workers will receive a pay rise as the National Minimum Wage and National Living Wage increase on 1 April. £1,000 a year pay rise for full-time workers following the largest ever uplift to the National Living Wage for workers aged 23 and over The...

by Ruth Clark | Apr 1, 2022 | HMRC

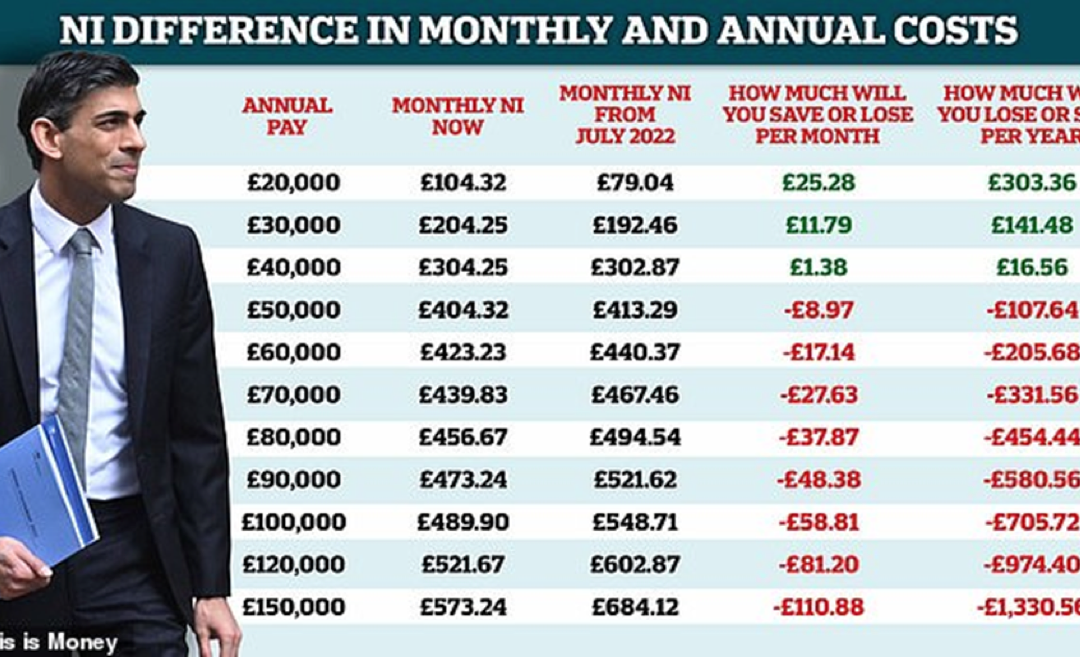

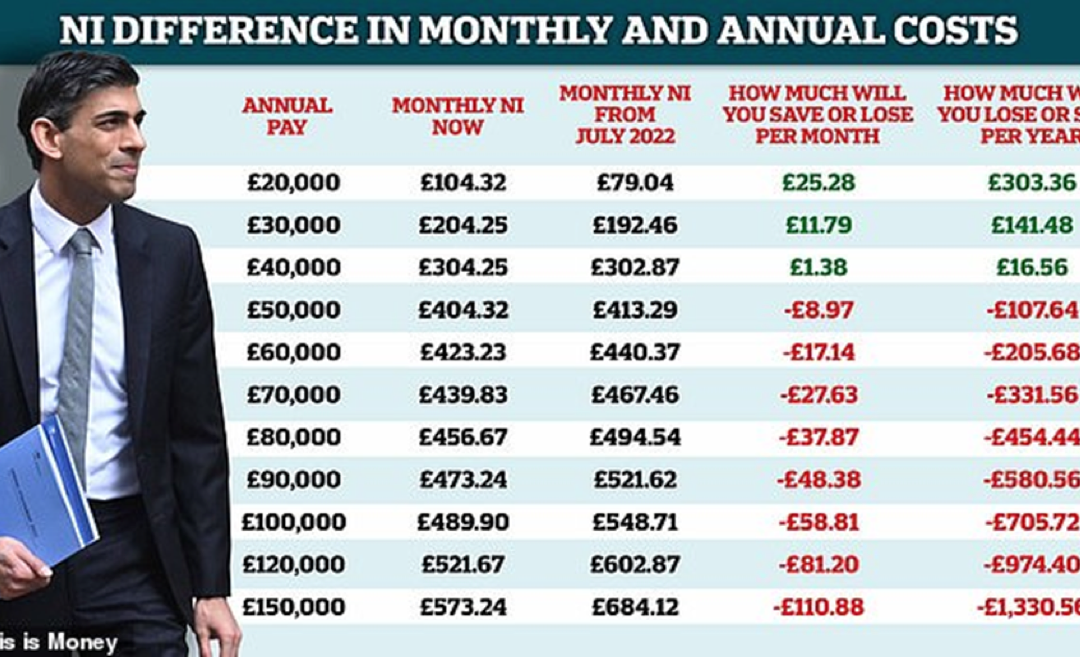

Taxes The threshold for paying National Insurance will increase by £3,000 from July. “People will be able to earn £12,570 a year without paying a single penny of income tax or national insurance.” The income tax basic rate will be cut from 20 per cent to...

by Ruth Clark | Apr 1, 2022 | HMRC, Tax

For expenditure incurred from 1 April 2021 until the end of March 2023. Which offers 130% first-year relief on qualifying main rate plant and machinery investments until 31 March 2023 for companies What are capital allowances? Capital allowances let taxpayers write...